Back in the days, due to non-availability of better technology, the tax officers used to manually reconcile the tax information submitted by the taxpayers.

As expected, these manual reconciliations were not error-free.

In today’s world also, due to a few technical glitches, these un-intentional mistakes happen.

To overcome these mistakes, tax officers have been powered to rectify mistakes via section 154.

Mistakes made by you can be rectified by simply filing a revised income tax return. [u/s 139(5)]

In this article, we will cover tax provision on rectification of mistakes apparent from available information by tax officers.

Stick with me!

Type of Mistakes which can be Rectified

Following mistakes can be corrected under section 154:

- Arithmetic mistake [happens when you file paper return]

- Error in Fact like TDS deducted but did not appear in form 26AS.

- Typing error by tax officers

- Others- There could be “n” number of error which can be rectified by referring valid documents.

Above Errors can be found in:

- An order passed under any provisions of the Income-tax Act

- An order stating that income tax return (ITR) has been checked by IT officer [u/s 143(1)]

- An order stating that TDS return has been checked by IT officer [u/s 200A]

- An order stating that TCS return has been checked by IT officer [u/s 206CB]

- An order passed under this section

Time Limit for Rectification under section 154

Rectification can be made within 4 years from the end of the year in which erroneous order was passed.

Example:

Intimation order u/s 143(1) passed on 31st August 2010

This order can be rectified up to 31st March 2015* [u/s 154]

* 4 years-From 1st April 2011 to 31st March 2015

Suppose the date of rectification is 10th Nov 2014 [For point no 3]

The order at point 2 can be further rectified up to 31st March 2019 [u/s 154]

How to Rectify Online – Mistakes made by CPC, Bangalore

Only return filed online can be rectified electronically through the below process. [Rectification process for a paper return is discussed after this]

You have to file an online application by login Income Tax E-filling website and then:

Step #1:

Go to “e-file” > “Rectification” > Rectification Request box will appear

Step #2:

Select Appropriate “Rectification Request Type”

Go for the next step without skipping any important fill-ups and press “Submit”.

Step #3:

After step #2, a reference number is generated. Keep that for further reference.

Check your work list for any updates.

For correcting the mistakes in the assessment of TDS or TCS return, you should visit TRACES website along with the credentials. [u/s 200A or 206CB]

How to Manually Rectify – Mistakes made by an Assessing Officer [AO]

Rectification request can be made to an assessing officer (AO) only if the case falls under his jurisdiction.

If it falls, then follow the below steps:

Step #1:

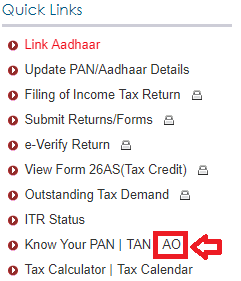

Find your Assessing officer by visiting the e-filing website [Left corner of the page under tab “Quick Link”]

Step #2:

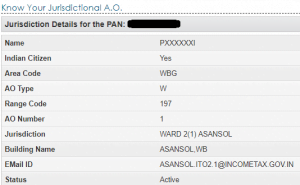

Enter your PAN and the registered phone number. Go with the OTP process

Step #3:

Draft a letter addressing your jurisdiction officer (download) and explain the mistakes with all proper details like PAN, Assessment year, the order in which the mistakes appears.

Attach the relevant document to justify your claim. [Like Form 16 for TDS mismatch claim]

Indicate the name of documents attached to the letter.

Submit the letter with the document to the address mentioned in step #2.

Also, carry a Xerox of your original letter to get an acknowledgement for your submission.

For Tax Expert: To represent a client before the AO a power of Attorney is required.

Step #4:

Wait for the reply from the department. [Check e-mail, mobile messages or letter]

Officer may ask for additional information and an explanation for your claim.

On being satisfied he will issue rectification order under section 154 within 6 months from the end of the month in which letter was filed.

Important Aspects of Section 154

- Tax Officer may on his own rectify the mistakes.

- A taxpayer will be given an opportunity to oppose any rectification order which leads to either an increase in his tax liability or decrease in the refund amount.

- A demand order will be issued for any tax liability arising from the rectification.

Happy Learning!

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS